$2.7 MILLION TIME PIECE

Banking records as far back as 1860 show Caleb Marshall as president of the Real Estate Bank of Delaware, which was located in Newport, DE. Caleb is the older brother of John Marshall (Kennett Bank President), and together they established an iron rolling mill on the Red Clay Creek in what is now known as Marshallton, DE. In late 1864, Franklin Q. Flinn was elected president of the bank as Caleb and his family were moving to Philadelphia to establish the Penn Treaty Iron Works for the manufacture of terne plate (early form of galvanized iron for which Caleb was issued patents). The $1 bill shown below, issued by the Real Estate Bank of Delaware, has Caleb Marshall’s signature as president. That is William Penn pictured and not Caleb Marshall.

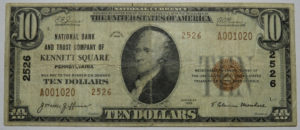

Caleb’s brother John was president of National Bank of Kennett Square from its founding in 1881 until his death in 1885, when E.B. Darlington became president. Darlington remained president until T. Elwood Marshall (Israel’s brother) assumed the presidency in 1915 and remained until 1922. His nephew T. Clarence Marshall became president in 1923 and remained in that office for 9 years. On July 1, 1930, the bank merged with Kennett Trust Company (formed in 1889) to become National Bank & Trust Company of Kennett Square, which was acquired in 1882 by Meridian Bank. Additional banking industry consolidations saw Meridian acquired by Corestates Bank and then First Union National Bank. In 2001, Wachovia Bank acquired First Union, and today its all part of Wells Fargo Bank.Before the Civil War, many states issued their own currency. As a means to pay for the war, reduce counterfeiting, and eliminate differences in currency value, the U.S. federal government created a national currency under Abraham Lincoln. By creating a system of nationally chartered banks, the government would print denominations of $1, $5, $10, $20, $50, $100, $500 and $1,000 bills to be issued by a “National Bank.” Every bank that changed their charter to that of a National Bank (and hence why there are so many First National Bank of…, Second National Bank of…, Third National Bank…, etc.) agreed to obey the rules for national currency. A bank was required to deposit a bond with the government for the value of government printed currency they received to place into public circulation. The government would print the name of the national bank on the currency and provide currency sheets to the requesting bank. Once each bill was hand-signed by the bank’s cashier and president, they could be hand-cut from the sheets (which is why you see the irregular borders in the images below) and issued to the bank’s customers. The system was in place from 1863 until the Great Depression in 1929, when a majority of the National Banks became insolvent. As a result, the U.S. government created our present Federal Reserve notes.

Caleb’s brother John was president of National Bank of Kennett Square from its founding in 1881 until his death in 1885, when E.B. Darlington became president. Darlington remained president until T. Elwood Marshall (Israel’s brother) assumed the presidency in 1915 and remained until 1922. His nephew T. Clarence Marshall became president in 1923 and remained in that office for 9 years. On July 1, 1930, the bank merged with Kennett Trust Company (formed in 1889) to become National Bank & Trust Company of Kennett Square, which was acquired in 1882 by Meridian Bank. Additional banking industry consolidations saw Meridian acquired by Corestates Bank and then First Union National Bank. In 2001, Wachovia Bank acquired First Union, and today its all part of Wells Fargo Bank.Before the Civil War, many states issued their own currency. As a means to pay for the war, reduce counterfeiting, and eliminate differences in currency value, the U.S. federal government created a national currency under Abraham Lincoln. By creating a system of nationally chartered banks, the government would print denominations of $1, $5, $10, $20, $50, $100, $500 and $1,000 bills to be issued by a “National Bank.” Every bank that changed their charter to that of a National Bank (and hence why there are so many First National Bank of…, Second National Bank of…, Third National Bank…, etc.) agreed to obey the rules for national currency. A bank was required to deposit a bond with the government for the value of government printed currency they received to place into public circulation. The government would print the name of the national bank on the currency and provide currency sheets to the requesting bank. Once each bill was hand-signed by the bank’s cashier and president, they could be hand-cut from the sheets (which is why you see the irregular borders in the images below) and issued to the bank’s customers. The system was in place from 1863 until the Great Depression in 1929, when a majority of the National Banks became insolvent. As a result, the U.S. government created our present Federal Reserve notes.

Above is an image of a $10 National Bank of Kennett Square bill issued April 26, 1921, with T. E. Marshall’s handwritten signature as president. Images of $10 and $20 National Currency bills (below) with T. Clarence Marshall’s lithograph-printed signatures show the bank’s name change to National Bank and Trust Company of Kennett Square. Over the 55-year life of the national currency program, National Bank of Kennett Square issued nearly $2.7 million in 15 different types and denominations of national currency. It is estimated that due to the higher-value denominations issued in later years, when TE and TC Marshall were presidents, that more than half the dollar value of $2.7 million total issued in National Currency by Kennett Bank displays a Marshall signature!!